Utu Whakawhanake - Development Contributions

The Utu Whakawhanake – Development Contributions Policy 2025 was formally adopted at the council’s extraordinary meeting on 7 October 2025 and will take effect from 29 May 2026.

Development contributions are charges levied by councils on developments that create additional demand for infrastructure. These contributions help fund new or expanded infrastructure – such as roads, water supply, wastewater, stormwater drainage, and community facilities – required to service growth.

The policy helps to ensure the costs of infrastructure related to growth are shared by those creating the demand, rather than falling mainly on ratepayers. There is also a requirement that contributions collected within a specific catchment must be spent on capital projects within that same area, improving transparency and local fairness.

The newly adopted Utu Whakawhanake Development Contributions Policy 2025 (Policy) includes demand generated by new subdivisions, buildings, or changes in land use that require resource consent, or building consent (e.g. converting a residential property into a commercial one). Under the policy, development contributions may be required when:

- A resource consent is granted.

- A building consent is granted.

- An authorisation for a service connection is granted.

- If the application or request is submitted on or after 29 May 2026.

- The development meets the test in clause 15.1 of the policy.

The full policy can be viewed here.

Credits

Credits recognise existing demand and past contributions, so that developments are not charged twice for the same level of service. These are not automatic and may only be applied in circumstances set out in clause 18 of the policy.

Where a qualifying development or financial contribution has already been paid, or an existing level of demand has been clearly established for the site, the council may apply credit to reduce the development contribution payable provided demand generated by a new or intensified development is higher than the credited demand as determined under clause 17 of the policy.

If a new or intensified development creates more demand than that recognised level, development contributions may still be charged in addition to any credit applied for the extra capacity required, even if there was a consent in place before 29 May 2026.

Remissions and exemptions

Some developments may be partially or fully remitted, or exempt, from development contributions under specific criteria in the policy (for example, certain Māori land or statutory exemptions). For details, including eligibility and how to apply, refer to Part D (Remissions, postponements and refunds) and clause 32 (Exemptions) of the policy.

If you disagree with an assessment

If you disagree with a development contributions assessment, you can request a reconsideration under section 198A of the Local Government Act 2002 and clause 28 of the policy. You may also lodge a formal objection to an assessment in accordance with Schedule 13A of the LGA and clause 29 of the policy.

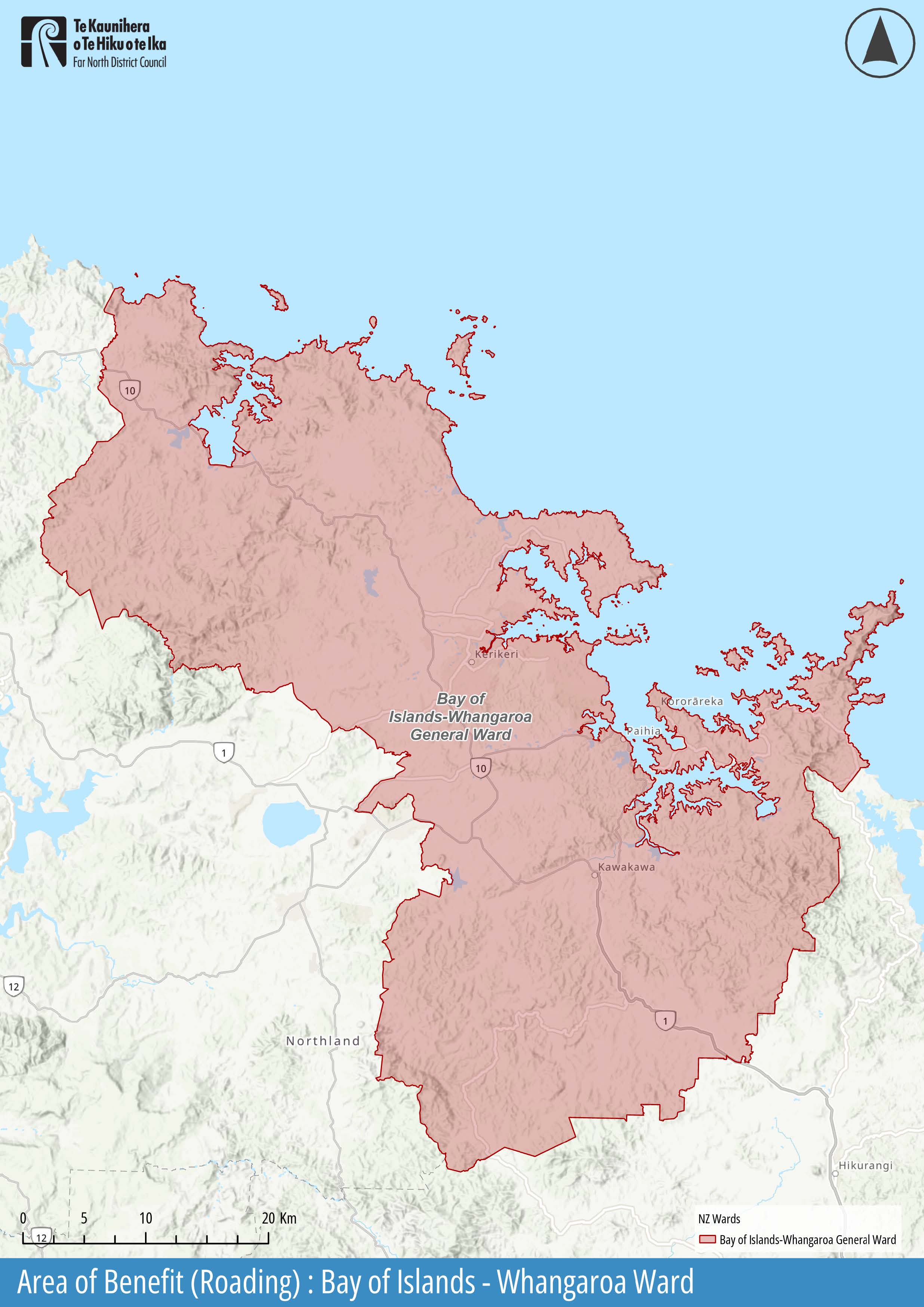

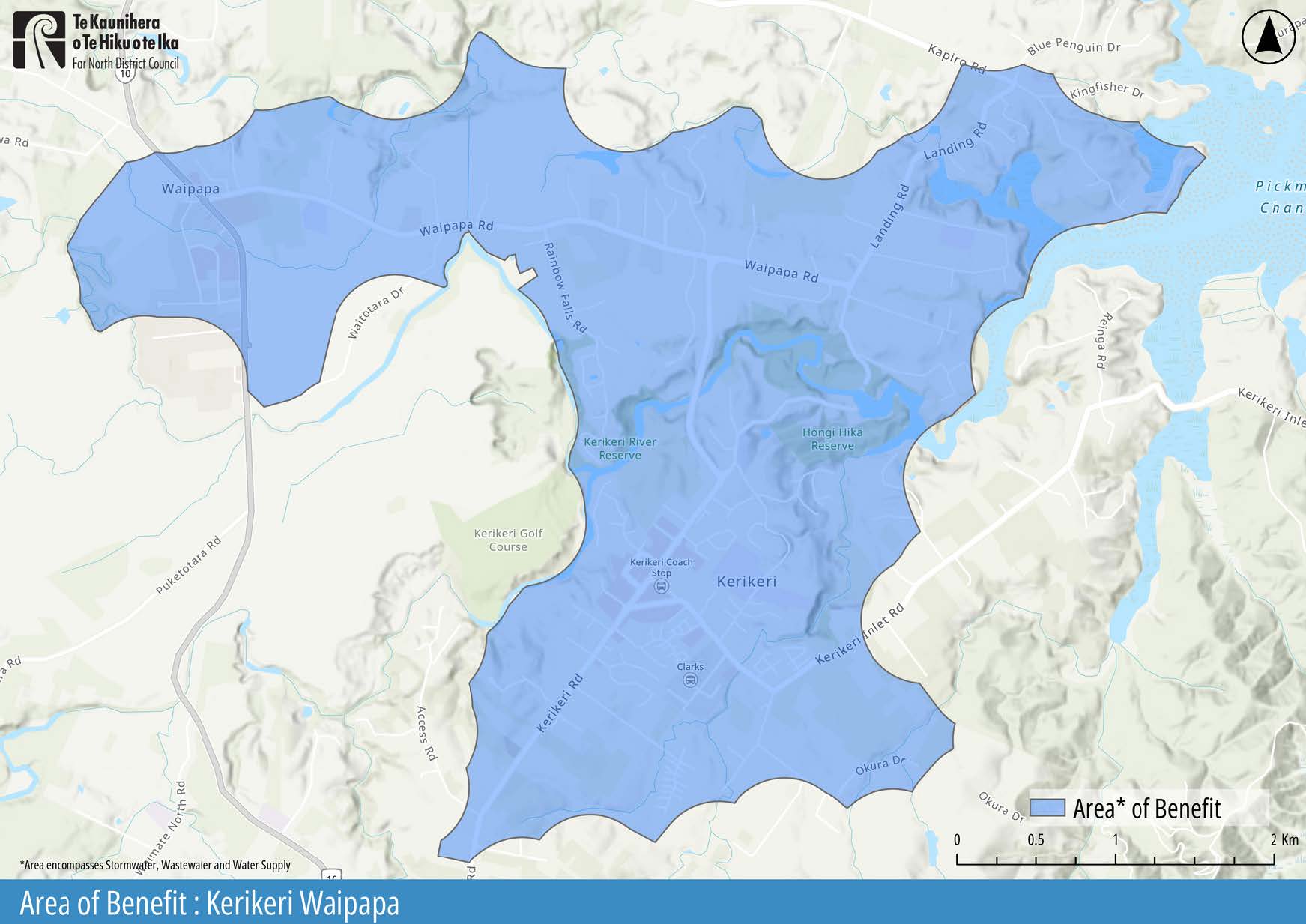

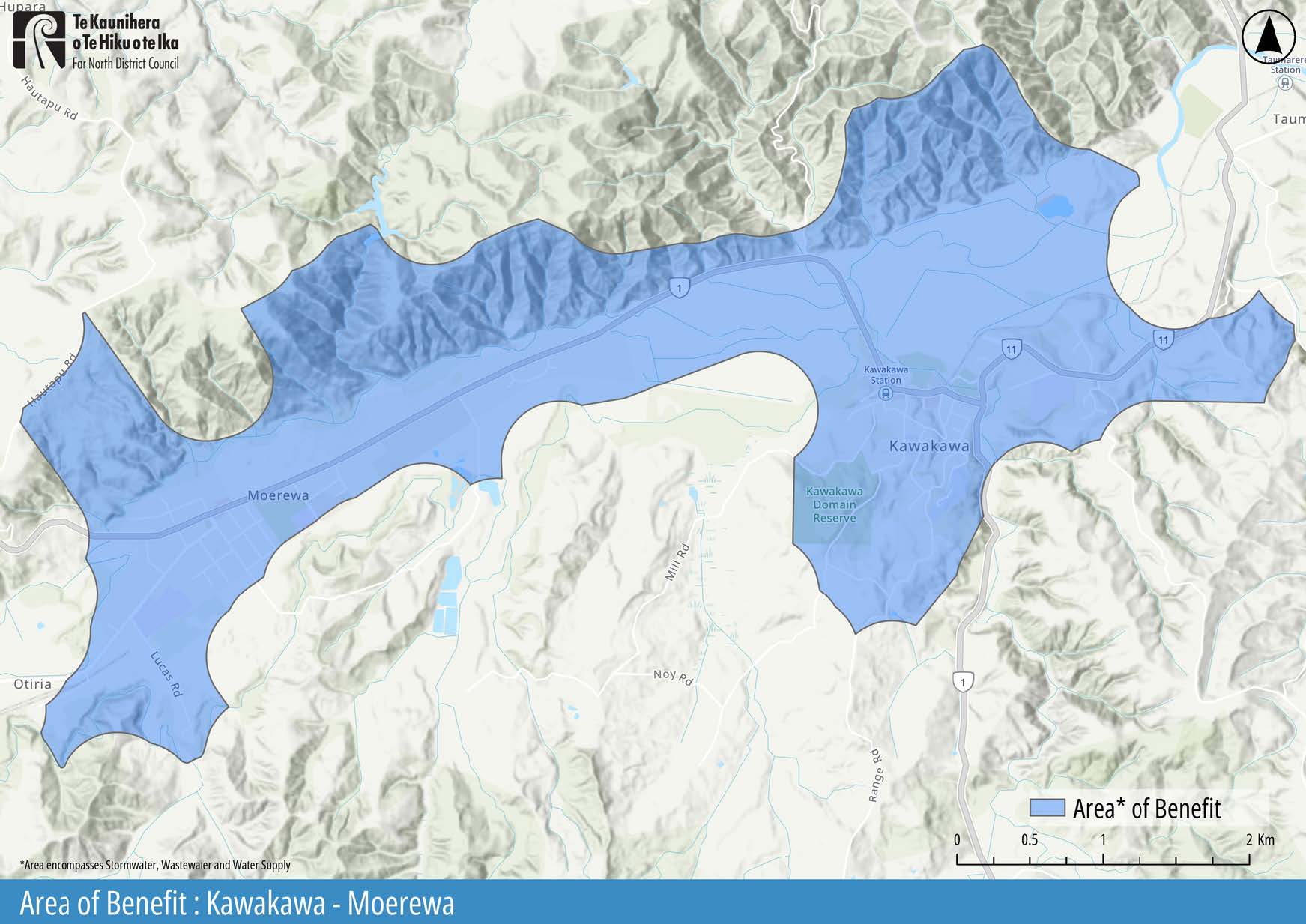

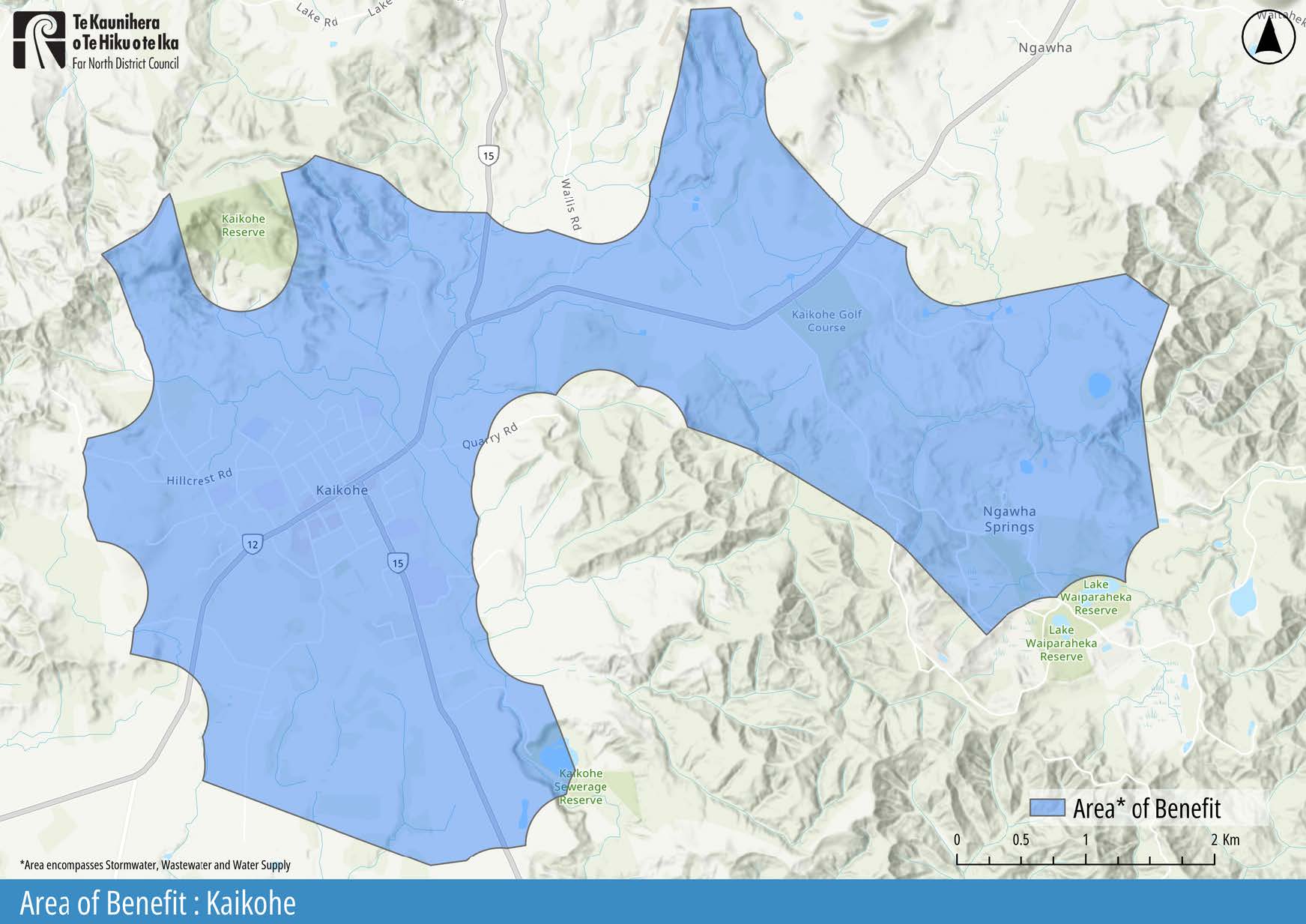

Catchment areas

You will only be charged a development contribution if your project is within any of the four catchments mapped below. If your project is outside those catchments, you do not need to pay a development contribution.

Frequently asked questions

No. If your resource consent application is submitted (with all required information) prior to the 29 May 2026, you will not be subject to a development contribution under the newly adopted policy. All applications for a subdivision, resource consent, building consent or service connection submitted on or after 29 May 2026 will be subject to a development contributions assessment under the policy. If they create additional demand for infrastructure as described in clause 15.1.

For a subdivision resource consent, as per clause 22 of the policy, the council will invoice for a development contribution at the time of the application for a certification under section 224c of the RMA. However, if you applied for your resource consent prior to the 29 May 2026, then your existing credit will apply under clause 18 of the policy and you will not be invoiced for a development contribution, unless the demand from your development exceeds the credited demand as determined under clause 17.

Under the policy, development contributions may be assessed when any of the following occur: a resource consent is granted, a building consent is granted, or an authorisation for a service connection is granted, provided the application or request is submitted on or after 29 May 2026 and the development meets the test in clause 15.1.

The “date of effect” clause confirms that the policy applies to any building consent or resource consent application, or request for authorisation for a service connection submitted (with all required information) on or after 29 May 2026. It also confirms that applications or requests lodged with all required information before 29 May 2026 are not subject to the policy, even if granted later. So:

- If a subdivision application (with all required information) is lodged before 29 May 2026, development contributions will not be charged under the policy at 224c for that consent. (Policy does not apply).

- If an application is made for a new water or wastewater service connection on or after 29 May 2026, that service connection can trigger a DC assessment for that service. (Policy applies and so credits also apply for developments as per clause 18.1).

- If the property is in a DC wastewater catchment, wastewater development contributions may be payable where the development generates wastewater demand, even if a physical wastewater connection cannot be made at that time. (Credits will apply under clause 18, although there may be a DC if the demand exceeds the demand recognised in the policy in accordance with clause 17. Any case where wastewater demand is genuinely nil or significantly lower than assumed, would need to be raised with supporting information for a potential special assessment).

Yes, Clause 56.1 and 56.2 of the policy refers to catchment areas. If the development is on a property that is (even partly) “located within” the mapped catchment, it is within the scope for applicable development contributions. Even if the development footprint is outside the mapped catchment, it is still liable if it can connect to a service network predominantly located in that catchment.

Clause 56.1 (Section 2 – Catchment Areas):

“Developments on properties located within these catchment areas, are liable for development contributions:

a. for roading and stormwater services

b. for water and wastewater services if a council provided water or wastewater scheme that is predominantly located within these areas is available.”

Clause 56.2: “For avoidance of doubt, development occurring outside of the catchment areas, but which is able to connect to a water or wastewater network that is predominantly located within the mapped catchment areas, will also be liable for development contributions for the relevant activity.”